In the world of business, whether you run a large corporation or a small enterprise, the movement of funds is the lifeline of operations. At the center of this flow are two critical financial concepts: Accounts Receivable (AR) and Accounts Payable (AP). If you’re a business owner, a financial professional, or an entrepreneur, you've likely encountered these terms. But what exactly are AR and AP, and why are they so essential? Let's dive into these financial pillars and their significance to business operations.

What Is Accounts Receivable (AR)?

Accounts Receivable (AR) refers to the money owed to a business by its customers after providing goods or services. In simpler terms, AR represents the debt that customers owe to the company. It’s the part of a transaction where the business has delivered but has yet to receive payment. Consequently, AR is listed as an asset on the company’s balance sheet, as it forecasts incoming cash flow.

For example, imagine you own a clothing company and supply merchandise to a retailer. You send an invoice with a 30-day payment term. Until that payment is made, the amount is recorded as AR. You haven’t received the cash yet, but you’re entitled to it at a future date.

What Is Accounts Payable (AP)?

Accounts Payable (AP) refers to the money a business owes to its suppliers for goods or services already received. Unlike AR, AP is a liability on the company’s balance sheet, representing the business’s obligation to pay.

For instance, let’s say your clothing company purchases fabric from a supplier with a 30-day payment term. Until you settle that amount, it is recorded as AP. You haven’t paid yet, but you’re responsible for making the payment within the agreed timeframe.

Why Are AR and AP So Important?

In business operations, AR and AP play a crucial role in cash flow management. They impact not only a company’s financial health but also its overall operational efficiency and strategy.

1. The Key to Cash Flow Management

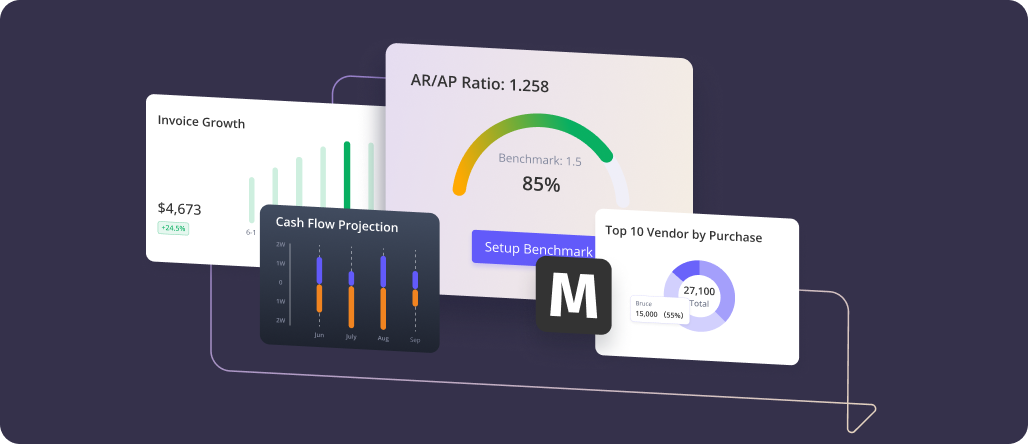

AR and AP directly reflect a company’s cash flow. Healthy cash flow is the foundation for business survival and growth, while AR and AP dictate the speed of cash in and out. Poorly managed AR can lead to a buildup of uncollected funds, constraining cash flow. On the flip side, mismanaged AP may result in excessive debt or delayed payments, which could harm supplier relationships.

2. Financial Transparency and Decision-Making

Effective AR/AP management provides clear financial transparency, helping business owners and management teams understand the flow of funds. With real-time insights into receivables and payables, businesses can make smarter financial decisions, avoiding cash shortages or unplanned expenditures. This level of transparency also informs broader business strategies.

3. Customer and Supplier Relationships

How you manage AR and AP can directly impact relationships with customers and suppliers. For AR, timely tracking and collection of unpaid invoices ensure that cash is flowing while maintaining good customer relationships. For AP, paying suppliers on time fosters strong credit and partnerships, and could even lead to better payment terms or pricing.

4. Improving Operational Efficiency

Many modern businesses juggle large volumes of AR and AP transactions. Without efficient management, finance teams can get bogged down in manual processes and reconciliation tasks, leading to operational inefficiencies. Streamlining AR/AP processes allows businesses to automate parts of their operations, reducing human error and boosting efficiency.

Best Practices for AR/AP Management

To ensure AR and AP effectively support cash flow and financial health, here are some key best practices:

1. Establish Clear Credit Policies

For AR, it’s essential to establish clear credit policies for customers. Setting reasonable credit limits and payment terms for different clients helps businesses control risk and maintain cash flow.

2. Regularly Review Receivables

Businesses should routinely review all outstanding receivables and follow up on overdue payments to avoid bad debt. Automated systems for reminders and tracking can significantly improve collection rates.

3. Optimize Payment Strategies

For AP, businesses should leverage payment terms effectively. If suppliers offer early payment discounts, companies can balance their cash flow to take advantage of these savings while maintaining good supplier relationships.

4. Leverage Technology to Boost Efficiency

Many companies are turning to smart financial management systems to simplify AR/AP processes. Automated reconciliation, invoice matching, and reminders enhance accuracy and efficiency, reducing the risk of human error.

AR and AP Are the Foundation of Financial Management

Accounts Receivable and Accounts Payable aren’t just financial jargon; they are the lifeblood of a company’s cash flow. By managing AR and AP efficiently, businesses can ensure a steady flow of funds, maintain strong customer and supplier relationships, and enhance overall financial transparency. In today’s business environment, more companies are turning to automation and intelligent technology to optimize AR/AP management, enabling them to better meet the demands of an ever-evolving market.

Regardless of size, businesses must not overlook AR and AP management. Mastering these core financial concepts and adopting the right strategies ensures a stable foundation for growth and competitiveness in a dynamic business landscape.